Investment Product Setup Guide

Investment Product Setup Guide

Creating and managing investment products is one of the most important features of Gobeller’s Investment Product Management module. With this setup, administrators can easily configure Investment Product, assign terms and interest rates, and make the product available for investors.

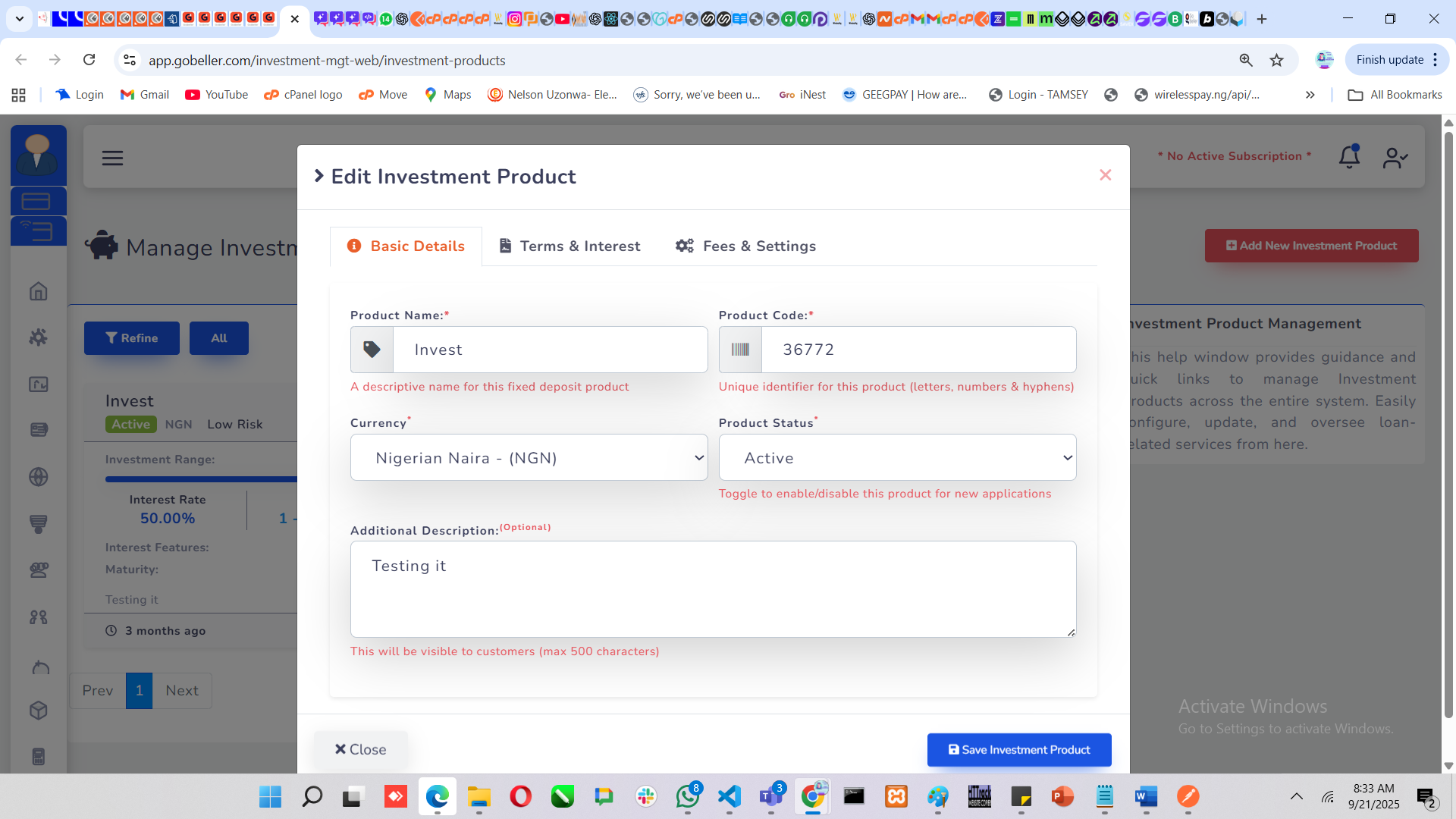

1. Basic Details

The first step in setting up an investment product is filling in the Basic Details section.

Product Name – A descriptive title for the investment (e.g., Invest, Fixed Saver, Premium Growth).

Product Code – A unique identifier generated for the product. This can be numbers, letters, or a combination.

Currency – Choose the currency in which this investment will run (e.g., Nigerian Naira – NGN).

Product Status – Select Active to make the product visible to customers or set it to Inactive to disable new subscriptions.

Additional Description – Provide a short description (max 500 characters) that explains the product features. This will be visible to investors on their dashboard.

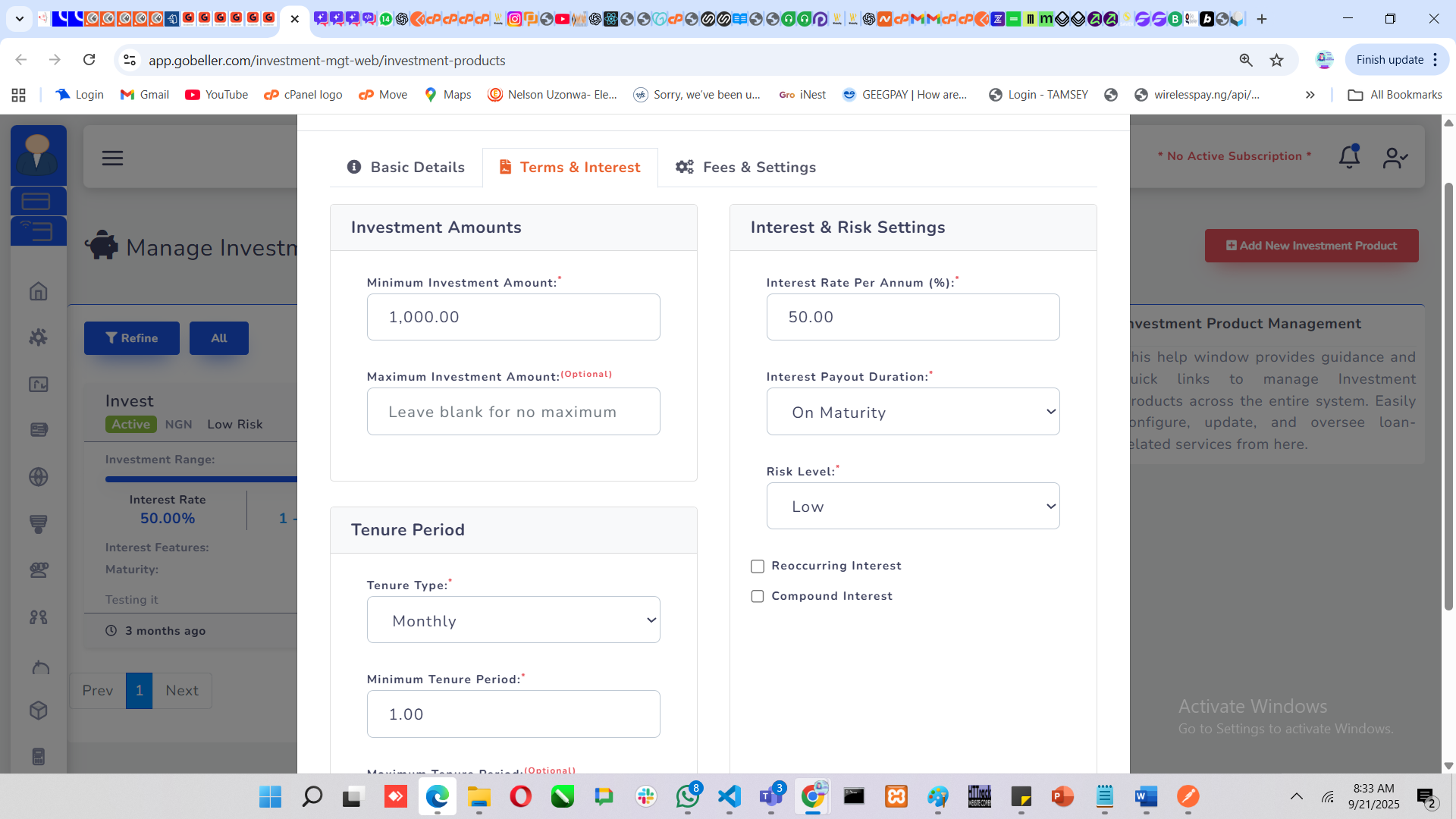

2. Terms & Interest Setup

Here, you define the financial terms that guide how the investment works.

Minimum Investment Amount – The least amount a customer can invest (e.g., ₦50,000).

Maximum Investment Amount – The highest amount a customer can invest (optional).

Interest Rate Per Annum (%) – Define the expected annual return (e.g., 20%).

Interest Payout Duration – Choose how investors receive returns:

On Maturity – Interest is paid at the end of the investment term.

Periodic – Interest is paid monthly, quarterly, etc.

Risk Level – Assign a risk rating (Low, Medium, High) so customers can make informed decisions.

Interest Options –

Recurring Interest – Interest is paid at the chosen interval.

Compound Interest – Interest is reinvested, allowing growth on both principal and earned interest.

3. Tenure Period Setup

The tenure defines how long an investment lasts.

Tenure Type – Choose whether the investment duration is calculated in Months or Years.

Minimum Tenure Period – The shortest duration (e.g., 1 month).

Maximum Tenure Period – The longest duration (e.g., 6 months).

This flexibility allows you to create short-term or long-term investment products tailored to customer needs.

4. Fees & Settings (Optional)

Depending on the configuration, you may also define management fees, early withdrawal penalties, or additional service charges. This ensures that all product rules are clearly documented and automated in the system.

5. Save & Publish

Once all details are completed:

Click Save Investment Product to register it in the system.

The product will now appear in the Investment Product Management dashboard, where it can be refined, updated, or disabled.

Why Proper Setup Matters

A well-structured investment product builds customer trust, ensures compliance with financial rules, and makes the system easy to manage. By carefully defining terms, interest, and risk levels, you create clear and attractive opportunities for your investors.

✨ With Gobeller’s platform, you can configure multiple investment products, monitor performance, and give your customers flexible ways to grow their wealth.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article